Soon after returning to office, President Donald Trump announced a plan to impose a broad-based 25 percent tariff on goods imported from Canada and Mexico beginning Feb. 1, unless those nations took sufficient action against illegal immigration and the fentanyl trade. New Tax Policy Center (TPC) analysis finds that such a tariff would result in just under a one-percent drop in after-tax income, on average. Additionally, TPC finds the 25 percent tariff would raise $110.5 billion in federal revenues in 2026, falling to just over $75 billion in 2035 due to likely changes in consumer behavior.

Canada and Mexico are two of the nation’s largest trading partners. In 2023, the US imported goods worth $475 billion from Mexico, its largest trading partner. The same year, the US imported nearly $419 billion in goods from Canada, its third-largest trading partner. The Trump administration’s proposed 25 percent tariff would apply to all imports from Canada and Mexico. However, in response, consumers may shift some purchases, choosing goods unaffected by this tariff. Companies may also choose to adjust supply chains and manufacture domestically or purchase their products from other countries not affected by these tariffs.

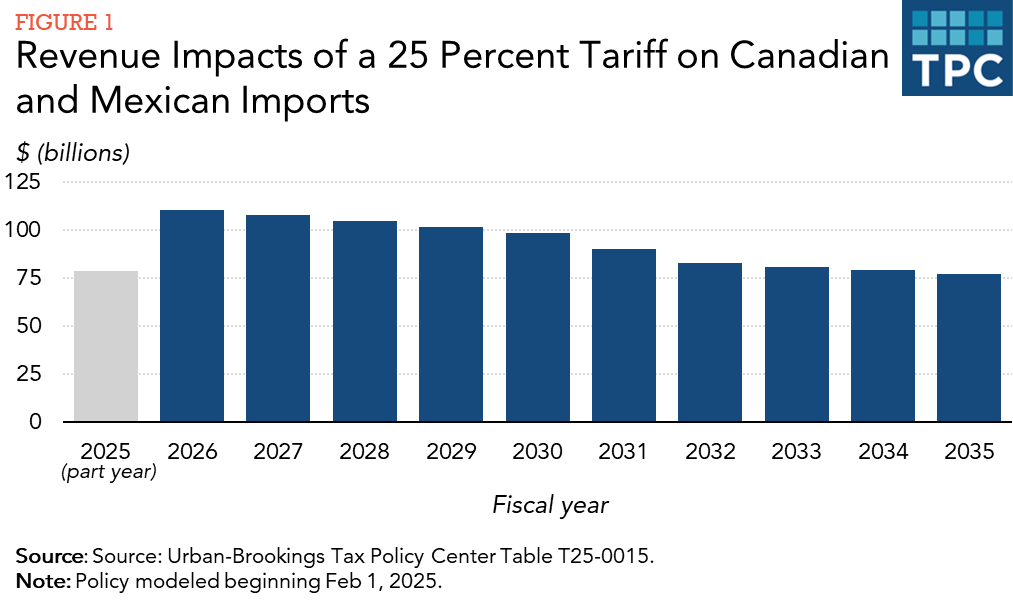

Under a 25 percent tariff, TPC estimates that American businesses would import 40 percent less from Canada and Mexico than they would otherwise. The tariff would raise $110.5 billion in fiscal year 2026. By comparison, the Congressional Budget Office projects that the federal government will raise just under $101 billion from excise taxes in the same period. Over ten years, TPC projects the proposed tariffs would raise over $1 trillion. However, these revenues would decline each year, reflecting consumers’ shift away from Canadian and Mexican imports.

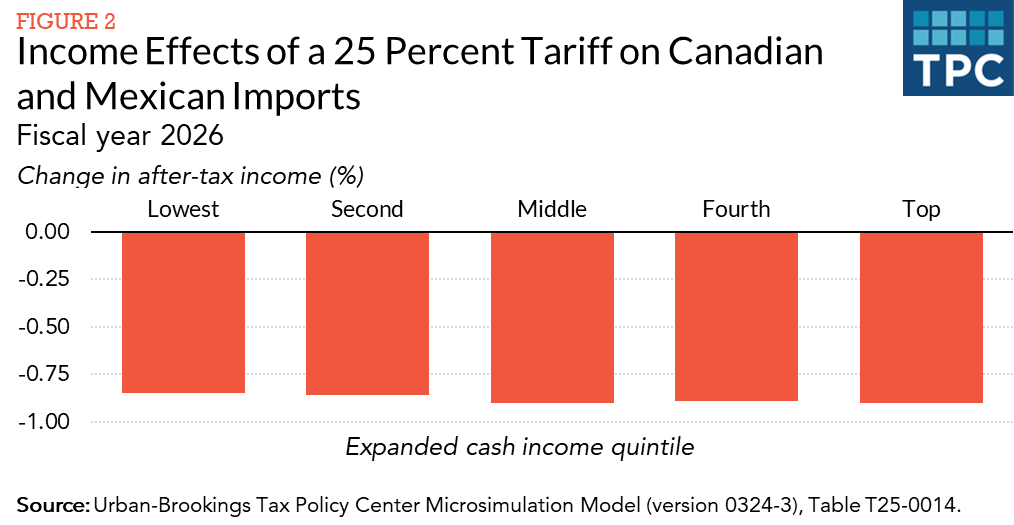

Research has shown that importing businesses and their domestic consumers bear the costs of tariffs, not the exporting nation. Importers account for the cost of tariffs in their pricing. TPC estimates that after-tax incomes would fall, on average, by $930 (just under 1 percent) in 2026 because of the 25 percent tariff. The lowest-income 20 percent of households would be worse off by an average of $170 while the wealthiest quintile by an average of $3,280 in that year.

TPC assumes the 25 percent tariff on imports from Canada and Mexico would go into effect February 1, 2025 and remain unchanged through the end of fiscal year 2035. (It has been reported that timing is not final, and these tariffs may be implemented March 1.) TPC also does not account for other tariffs that may prevent consumers from shifting away from Canadian and Mexican imports and allocates the costs of tariffs by the end consumer of a given import.

While consumers may face only a modest decrease in after-tax incomes from a 25 percent tariff on imports from Canada and Mexico, depending on their sector, businesses and their employees may be deeply affected. Nearly all US natural gas imports are from Canada, and the US imports large amounts of automobiles and machinery from both. Uncertainty about tariffs—their implementation, amount, and timing—only adds to these potential challenges for the economy as a whole, and specific sectors.