Three tax credits for families with children, low-income workers, and first-time homebuyers proposed by Democratic presidential candidate Kamala Harris would reduce federal tax revenues by $2 trillion over the next decade. But, as she has claimed, they’d largely benefit low- and middle-income households, according to a new Tax Policy Center analysis.

TPC projected that more than 70 percent of households making about $113,000 or less (the lowest-income half) would benefit from at least one of these three tax breaks. Overall, they’d lower 2025 household taxes by an average of $750, or about 0.7 percent of after-tax income. About 28 percent of all households would benefit from at least one of the three subsidies Harris proposed and TPC modeled.

What TPC Modeled

TPC included Harris’s plan to make the Child Tax Credit (CTC) available to more very low-income families and increase the credit amount from $2,000 to up to $6,000 per child, depending on their age; her proposed expansion of the Earned Income Tax Credit (EITC), especially for workers who do not live with their children; and a refundable tax credit of up to $25,000 for first-time homebuyers.

Since Harris has not described details of her homebuyer subsidy, TPC modeled a stylized tax credit. She could structure that assistance as a cash grant, though the Biden Administration’s 2025 budget uses a tax credit for a similar proposal.

TPC’s analysis does not include other Harris tax cut proposals such as subsidies for home builders or tax increases such as higher tax rates on capital gains, a minimum tax on wealthy taxpayers, and higher corporate tax rates. TPC previously analyzed plans to exempt tipped income from federal tax, ideas that have been proposed both by Harris and her GOP challenger Donald Trump.

The Cost

By far the most costly of the three proposals would be Harris’s proposed expansion of the Child Tax Credit (CTC). It would reduce tax revenues by nearly $1.6 trillion between 2025 and 2034, compared to current law, TPC estimated.

Her EITC expansion would cost about $140 billion and her homebuyer tax credit would reduce federal revenues by about $300 billion. The homebuyer’s credit could be much more expensive if it, and other housing-related subsidies she proposed, encourage more people to buy homes.

Who Benefits

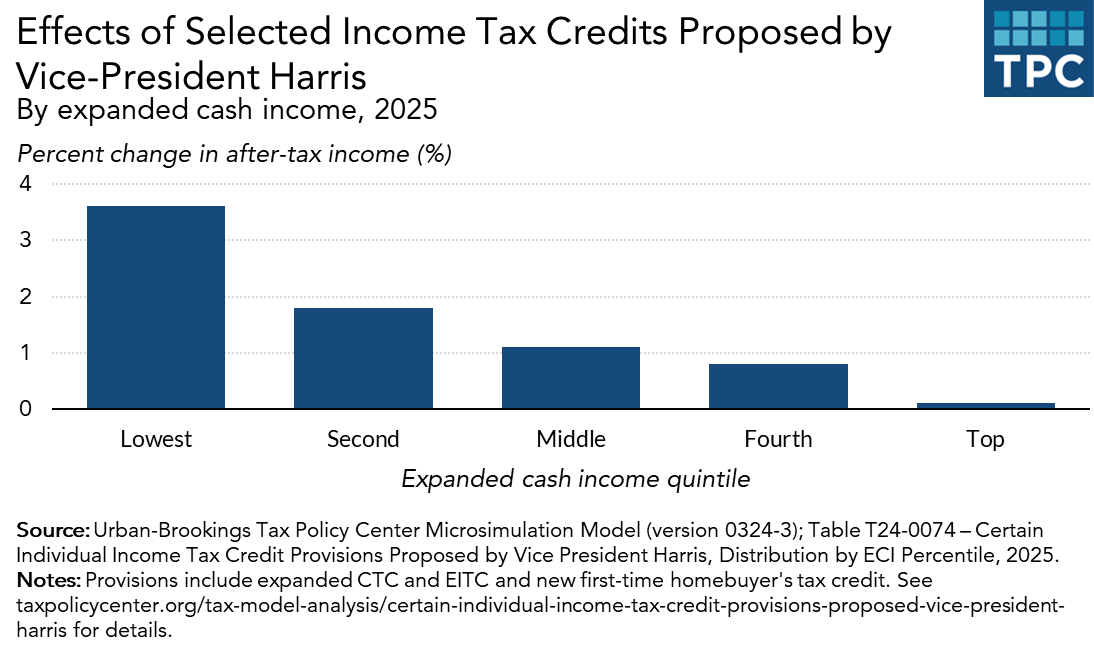

As a share of income, households making about $33,000 or less (the lowest income 20 percent) would be the biggest winners. Their after-tax incomes would rise by 3.6 percent, or almost $700 on average in 2025.

While high-income households would receive some benefit, it would be very small. The highest-income 20 percent of households would get an average tax cut of only about 0.1 percent, or about $350. And the top 1 percent would get no tax cut at all, on average.

Because Harris’s tax cuts are so highly targeted, there are big differences even within income groups.

For example, about 36 percent of all of the lowest-income households would get a tax cut, averaging about $700. But among those households with children, more than three-quarters would get a tax cut, averaging about $2,800. By contrast, since older adults are unlikely to have young children or to be first-time homebuyers, many fewer would benefit. For example, only about 7 percent of low-income older adults would get a tax cut, averaging only about $150.

Overall, Harris’s troika of low- and middle-income tax cuts would benefit only a bit more than one-quarter of households. But those who do qualify would enjoy generous tax breaks. That would be especially true of very low-income parents.